Fed accelerates treasury purchases as Trump eyes unconventional debt strategy

12/11/2025 / By Finn Heartley

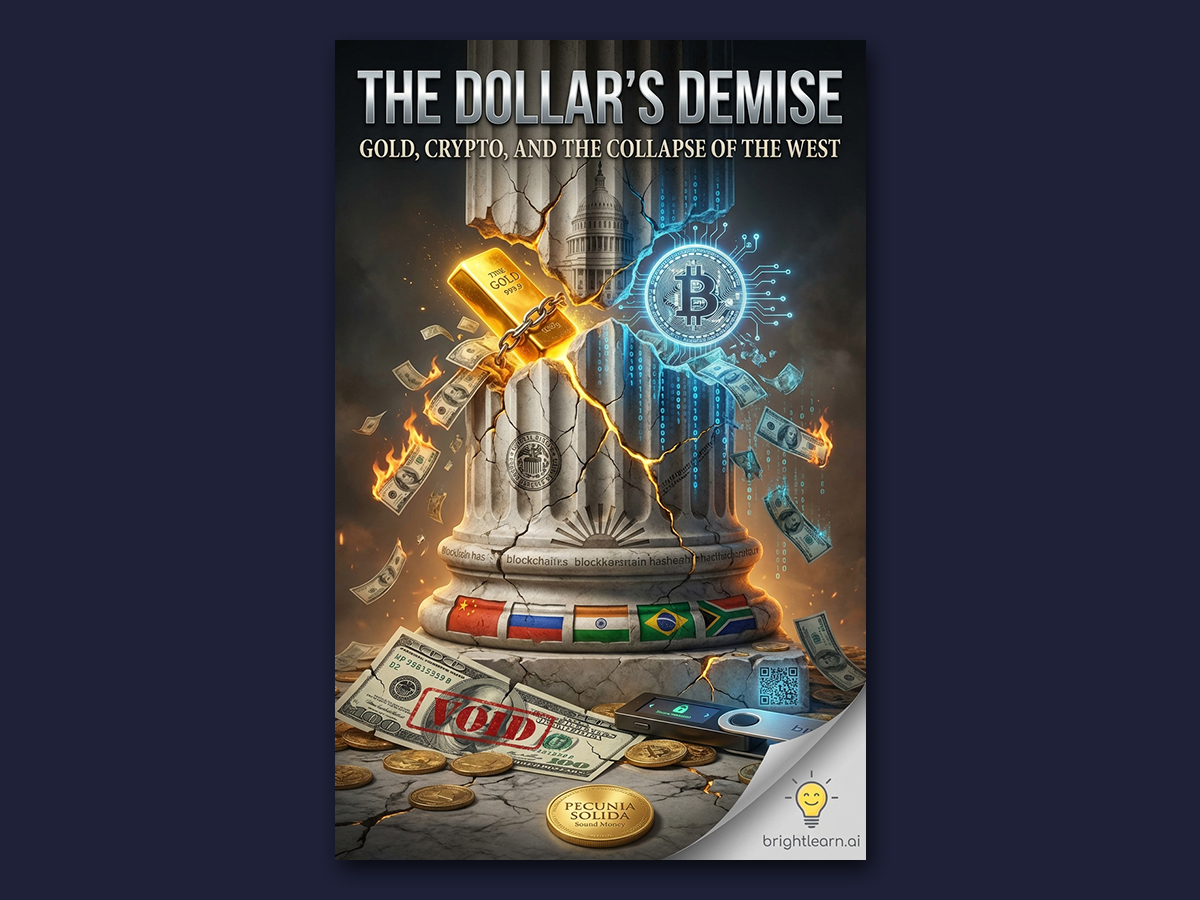

- Fed Resumes Risky Stimulus: The Federal Reserve plans $40B/month Treasury purchases, mimicking COVID-era money printing, risking hyperinflation and dollar collapse while temporarily delaying economic reckoning. Gold and silver surge as investors flee fiat.

- Dollar in “Final Blowout Stage”: Analyst Mike Adams warns the Fed is artificially propping up Treasury demand, accelerating inflation, and middle-class impoverishment. Silver prices doubled since 2024, exposing suppressed COMEX pricing schemes.

- Trump’s Debt Refinancing Gamble: The administration pushes ultra-low Treasury yields to ease debt burdens while proposing retroactive tax refunds—flooding the economy with liquidity but risking runaway inflation by 2026.

- Physical Assets Over Paper Claims: With banks unstable and FDIC reserves covering <2% of potential failures, Adams urges holding physical gold/silver—not ETFs—and decentralized cryptocurrencies like Monero to avoid counterparty risk.

- BRICS Threatens Dollar Dominance: As BRICS nations adopt gold-backed trade, U.S. financial control weakens. Seizures of Venezuelan oil and Malaysia’s BRICS entry signal desperation. Survival hinges on self-sufficiency and tangible assets.

The Federal Reserve has reignited concerns over hyperinflation by announcing a return to aggressive monetary policy, pledging $40 billion per month in Treasury purchases—a move reminiscent of COVID-era stimulus measures. Critics warn this strategy risks accelerating the dollar’s devaluation, while proponents argue it buys temporary relief before an inevitable monetary reckoning.

The Fed’s decision, widely seen as pressured by the Trump administration, signals desperation as faith in fiat currency dwindles. Silver prices surged to 62 per ounce overnight—a staggering triple from pre?2020 levels — while gold breached 2,400, reflecting investor flight from dollar-denominated assets. Analysts predict gold could surpass $5,000/oz, not due to gold’s rising value but the dollar’s accelerating collapse.

The Final Blowout Stage of the Dollar

Mike Adams, founder of Brighteon.com and financial analyst, warns that this marks the “final blowout stage” of the U.S. financial system. The Fed’s Treasury purchases—effectively printing money to buy government debt—reveal a snake “eating its own tail.” With dwindling foreign demand for U.S. debt, the Fed now props up the Treasury market artificially, exacerbating inflation and eroding middle-class purchasing power.

Adams notes silver’s meteoric rise—doubling since early 2024—indicates markets are breaking free from price suppression schemes like COMEX derivatives. “The prices you see are fake,” he asserts, urging investors to secure physical silver before premiums skyrocket further.

Trump’s Unorthodox Economic Playbook

The Trump administration’s push for ultra-low Treasury yields aims to refinance national debt at reduced rates. Simultaneously, plans for retroactive tax refunds—potentially refunding five years’ worth of federal taxes—could flood the economy with liquidity, staving off civil unrest but risking runaway inflation.

Adams warns these measures are unsustainable: “The government has ‘magic money machines’—they’ll print until the dollar is worthless.” He predicts hyperinflationary collapse by 2026, urging asset diversification into gold, silver, and decentralized alternatives like privacy cryptocurrencies (Monero, XMR).

Counterparty Risk and Survival Strategies

With banks teetering and FDIC reserves covering less than 2% of potential failures, Adams emphasizes zero-counterparty-risk assets: physical metals, not ETFs or paper silver. His new book, Vanishing Vaults, details methods to cache gold and silver securely—from rain barrels to freezer stashes—ahead of systemic breakdown.

Global Implications: BRICS and the End of Petrodollar Dominance

As BRICS nations advance gold-backed trade systems, U.S. financial hegemony wanes. Recent piracy-style seizures of Venezuelan oil tankers underscore desperation, while Malaysia’s BRICS accession threatens dollar reliance in critical shipping lanes like the Strait of Malacca.

Adams concludes: “The empire is past its expiration date. Prepare for a world where ‘grow it or make it’ is survival.”

Watch the Dec. 11 episode of “Brighteon Broadcast News” as Mike Adams, the Health Ranger, talks about the final stage of spiraling inflation and dollar collapse.

This video is from the Health Ranger Report channel on Brighteon.com.

More related stories:

Could Trump Abolish the IRS? Libertarians Weigh In on Tax Reform and Federal Overhaul

Sources include:

Submit a correction >>

Tagged Under:

big government, Bubble, business, constitution, corruption, DOGE, dollar demise, Donald Trump, economic freedom, economic riot, External Revenue Service, finance, government debt, government taxation, income tax, individual freedom, IRS, irs corruption, IRS overhaul, money supply, pensions, progressive tax, risk, streamlined approach, Trump

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2018 CRYPTOCULT.NEWS

All content posted on this site is protected under Free Speech. CryptoCult.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. CryptoCult.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.